February Recap

Although the month of February isn't over just yet, I do have a few topics in mind to put down. Plus, I doubt I'll be making a lot of trades for the rest of this month. This will be covered in the second half of my post.

The first half of this post is around interest rates. Specifically, interest rate cuts. This is what most economies are currently anticipating, except for Japan where they're predicting that the Bank of Japan will exit negative rates.

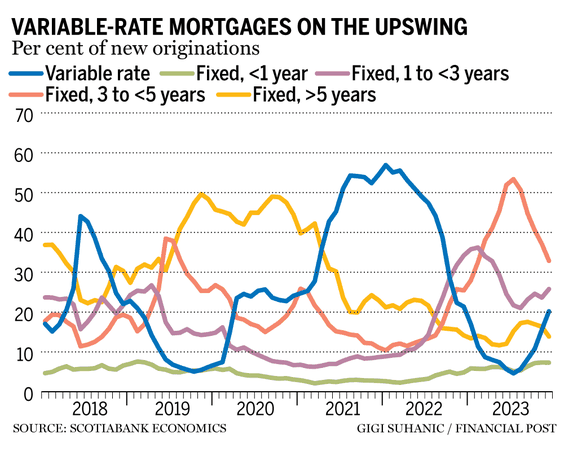

According to this Financial Post article, more and more Canadians are choosing variable rate mortgages. This is in anticipation of a decreasing interest.

|

| CADJPY Daily |

I'm using JPY as the quote currency to maximize the interest rate differential. As you can observe on this chart, the Canadian dollar sold off against the Japanese yen in December 2023. Around that time, the market was pricing in interest rate cuts to occur across the scheduled Bank of Canada announcements throughout 2024.

Since then, there's been an accumulation of the Canadian dollar, meaning position traders are back to riding the uptrend to make that interest rate differential play. They're essentially betting on higher rates for longer.

To summarize, there are two prevailing sentiments when it comes to interest rates - higher for longer and rate cuts. Unforuntately, this means my February's trading performance suffered quite a bit and I think this is a good segway into that.

I'm still following my trend-trading strategy by sizing up when there are trend continuation breakouts. I have been able to capitalize on these opportunities, but the trends tend to be shortlived. The real killer was when I took breakout, sometimes countertrend, scalp trades targeting 1.5 ATR.

Let's use USDCHF as the prime example in this post-trade review.

|

| USDCHF Daily |

In my review of historical chart data, I've found that counter-trend breakouts have profit potential. It's just a matter of setting closer targets, which I chose 1.5x ATR.

Running through the above example:

- Pair is determined to be in an uptrend because price is above both EMAs and the EMA-20 is above the EMA-60

- A tight consolidation has formed so I plotted upper and lower range boundaries based on my methodology by marking the first level based on the pullback move

- As price crossed below the lower range boundary, I entered short with a profit target of 75 pips because the ATR-10 at the entry time was 51 pips

- Is it even worth scalping these counter-trend moves by targeting 1.5x ATR or even less? I would need a win rate of just under 50% for long-run profitability. In addition, it locks up my margin and I cannot size up.

- If I were to continue scalping counter-trend moves, is it worth targeting 1x ATR or even 0.9x ATR?